|

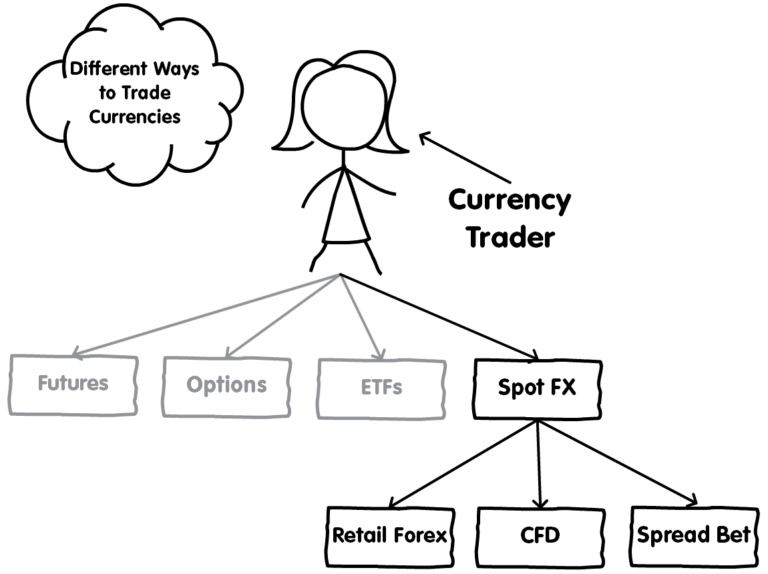

Because forex is so awesome, traders came up with a number of different ways to invest or speculate in currencies. Among the financial instruments, the most popular ones are retail forex, spot FX, currency futures, currency options, currency exchange-traded funds (or ETFs), forex CFDs, and forex spread betting. It’s important to point out that we are covering the different ways that individual (“retail”) traders can trade FX. Other financial instruments like FX swaps and forwards are not covered since they cater to institutional traders. With that out of the way, let’s now discuss how you can partake in the world of forex. Currency FuturesFutures are contracts to buy or sell a certain asset at a specified price on a future date (That’s why they’re called futures!). A currency future is a contract that details the price at which a currency could be bought or sold, and sets a specific date for the exchange. Currency futures were created by the Chicago Mercantile Exchange (CME) way back in 1972 when bell-bottoms and platform boots were still in style. Since futures contracts are standardized and traded on a centralized exchange, the market is very transparent and well-regulated. This means that price and transaction information are readily available. You can learn more about CME’s FX futures here. Currency OptionsAn “option” is a financial instrument that gives the buyer the right or the option, but not the obligation, to buy or sell an asset at a specified price on the option’s expiration date. If a trader “sold” an option, then he or she would be obliged to buy or sell an asset at a specific price at the expiration date. Just like futures, options are also traded on an exchange, such as the Chicago Mercantile Exchange (CME), the International Securities Exchange (ISE), or the Philadelphia Stock Exchange (PHLX). However, the disadvantage in trading FX options is that market hours are limited for certain options and the liquidity is not nearly as great as the futures or spot market. Currency ETFsA currency ETF offers exposure to a single currency or basket of currencies. Currency ETFs allow ordinary individuals to gain exposure to the forex market through a managed fund without the burdens of placing individual trades. Currency ETFs can be used to speculate on forex, diversify a portfolio, or hedge against currency risks. Here’s a list of the most popularly traded currency ETFs. ETFs are created and managed by financial institutions that buy and hold currencies in a fund. They then offer shares of the fund to the public on an exchange allowing you to buy and trade these shares just like stocks. Like currency options, the limitation in trading currency ETFs is that the market isn’t open 24 hours. Also, ETFs are subject to trading commissions and other transaction costs. Spot FXThe spot FX market is an “off-exchange” market, also known as an over-the-counter (“OTC”) market. The off-exchange forex market is a large, growing, and liquid financial market that operates 24 hours a day. It is not a market in the traditional sense because there is no central trading location or “exchange”. In an OTC market, a customer trades directly with a counterparty. Unlike currency futures, ETFs, and (most) currency options, which are traded through centralized markets, spot FX are over-the-counter contracts (private agreements between two parties). Most of the trading is conducted through electronic trading networks (or telephone). The primary market for FX is the “interdealer” market where FX dealers trade with each other. A dealer is a financial intermediary that stands ready to buy or sell currencies at any time with its clients. The interdealer market is also known as the “interbank” market due to the dominance of banks as FX dealers. The interdealer market is only accessible to institutions that trade in large quantities and have a very high net worth. This includes banks, insurance companies, pension funds, large corporations, and other large financial institutions manage the risks associated with fluctuations in currency rates. In the spot FX market, an institutional trader is buying and selling an agreement or contract to make or take delivery of a currency. A spot FX transaction is a bilateral (“between two parties”) agreement to physically exchange one currency against another currency. This agreement is a contract. Which means this spot contract is a binding obligation to buy or sell a certain amount of foreign currency at a price which is the “spot exchange rate” or the current exchange rate. So if you buy EUR/USD on the spot market, you are trading a contract that specifies that you will receive a specific amount of euros in exchange for U.S dollars at an agreed-upon price (or exchange rate). It’s important to point out that you are NOT trading the underlying currencies themselves, but a contract involving the underlying currencies. Even though it’s called “spot”, transactions aren’t exactly settled “on the spot”. In reality, while a spot FX trade is done at the current market rate, the actual transaction is not settled until two business days after the trade date. This is known as T+2 (“Today plus 2 business days”). It means that delivery of what you buy or sell should be done within two working days and is referred to as the value date or delivery date. For example, an institution buys EUR/USD in the spot FX market. The trade opened and closed on Monday has a value date on Wednesday. This means that it’ll receive euros on Wednesday. Not all currencies settle T+2 though. For example, USD/CAD, USD/TRY, USD/RUB and USD/PHP value date is T+1, meaning one business day going forward from today (T). Trading in the actual spot forex market is NOT where retail traders trade though. Retail ForexThere is a secondary OTC market that provides a way for retail (“poorer”) traders to participate in the forex market. Access is granted by so-called “forex trading providers“. Forex trading providers trade in the primary OTC market on your behalf. They find the best available prices and then add a “markup” before displaying the prices on their trading platforms. This is similar to how a retail store buys inventory from a wholesale market, adds a markup, and shows a “retail” price to their customers. Although a spot forex contract normally requires delivery of currency within two days, in practice, nobody takes delivery of any currency in forex trading. The position is “rolled” forward on the delivery date. Especially in the retail forex market. Remember, you are actually trading a contract to deliver the underlying currency, rather than the currency itself. It’s not just a contract, it’s a leveraged contract. Retail forex traders can’t “take or make delivery” on leveraged spot forex contracts. Leverage allows you to control large amounts of currency for a very small amount. Retail forex brokers let you trade with leverage which is why you can open positions valued at 50 times the amount of the initial required margin. So with $2,000, you can open a EUR/USD trade valued at $100,000. Imagine if you went short EUR/USD and had to deliver $100,000 worth of euros! You’d be unable to settle the contract in cash since you only have $2,000 in your account. You wouldn’t have enough funds to cover the transaction! So you either have to close the trade before it settles or “roll” it over. To avoid this hassle of physical delivery, retail forex brokers automatically “roll” client positions. This is how you avoid being forced to accept (or deliver) 100,000 euros. Retail forex transactions are closed out by entering into an equal but opposite transaction with your forex broker. For example, if you bought British pounds with U.S. dollars, you would close out the trade by selling British pounds for U.S. dollars. This is also called an offsetting or liquidating a transaction. If you have a position left open at the close of the business day, it will be automatically rolled over to the next value date to avoid the delivery of the currency. Your retail forex broker will automatically keep on rolling over your spot contract for you indefinitely until it is closed. The procedure of rolling the currency pair over is known as Tomorrow-Next or “Tom-Next“, which stands for “Tomorrow and the next day.” When positions are rolled over, this results in either interest being paid or earned by the trader. These charges are known as a swap fee or rollover fee. Your forex broker calculates the fee for you and will either debit or credit your account balance. Retail forex trading is considered speculative. This means traders are trying to “speculate” or make bets on (and profit from) the movement of exchange rates. They’re not looking to take physical possession of the currencies they buy or deliver the currencies they sell Forex Spread BetSpread betting is a derivative product, which means you don’t take ownership of the underlying asset but speculate on whichever direction you think its price will move up or down A forex spread bet enables you to speculate on the future price direction of a currency pair. A currency pair’s price being used on the spread bet is “derived” from the currency pair’s price on the spot FX market. Your profit or loss is dictated by how far the market moves in your favor before you close your position and how much money you have bet per “point” of price movement. Spread betting on forex is provided by “spread betting providers“. Unfortunately, if you live in the U.S., spread betting is considered illegal. Despite being regulated by the FSA in the U.K., the U.S. consider spread betting to be internet gambling which is currently forbidden. Forex CFDA contract for difference (“CFD”) is a financial derivative. Derivative products track the market price of an underlying asset so that traders can speculate on whether the price will rise or fall.

The price of a CFD is “derived” from the underlying asset’s price. A CFD is a contract, typically between a CFD provider and a trader, where one party agrees to pay the other the difference in the value of a security, between the opening and closing of the trade. In other words, a CFD is basically a bet on a particular asset going up or down in value, with the CFD provider and you agree that whoever wins the bet will pay the other the difference between the asset’s price when you enter the trade and its price when you exit the trade. A forex CFD is an agreement (“contract”) to exchange the difference in the price of a currency pair from when you open your position versus when you close it. A currency pair’s CFD price is “derived” from the currency pair’s price on the spot FX market. (Or at least it should be. If not, what is the CFD provider basing its price on? 🤔) Trading forex CFDs gives you the opportunity to trade a currency pair in both directions. You can take both long and short positions. If the price moves in your chosen direction, you would make a profit, and if it moves against you, you would make a loss. In the EU and UK, regulators decided that “rolling spot FX contracts” are different from the traditional spot FX contract. The main reason being is that with rolling spot FX contracts, there is no intention to ever take actual physical delivery (“take ownership”) of a currency, its purpose is to simply speculate on the price movement in the underlying currency. The objective of trading a rolling spot FX contract is to gain exposure to price fluctuations related to the underlying currency pair without actually owning it. So to make this differentiation clear, a rolling spot FX contract is ruled as a CFD. (In the U.S., CFDs are illegal so it’s known as a “retail forex transaction”) Forex CFD trading is provided by “CFD providers“. Outside the U.S., retail forex trading is usually done with CFDs or spread bets.

0 Comments

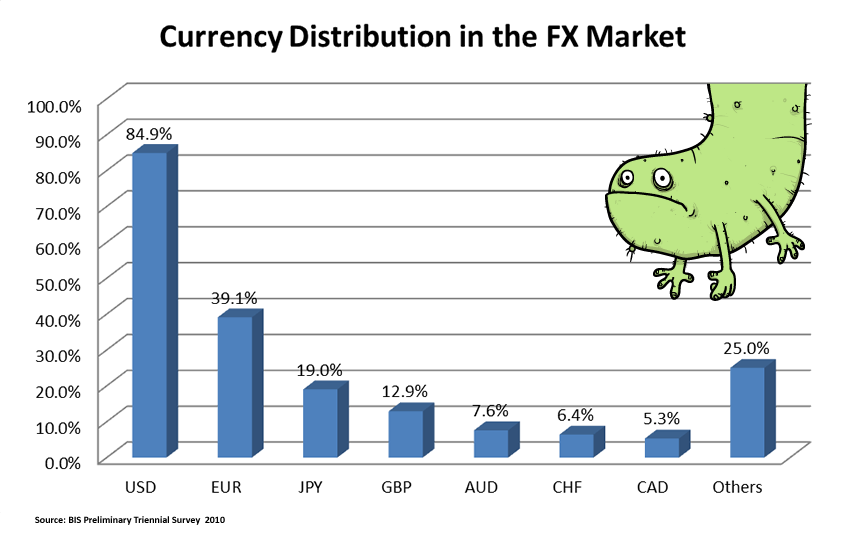

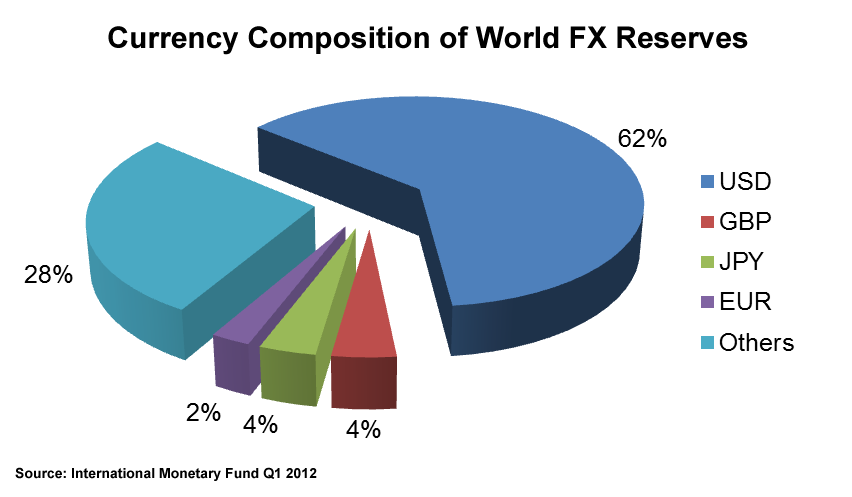

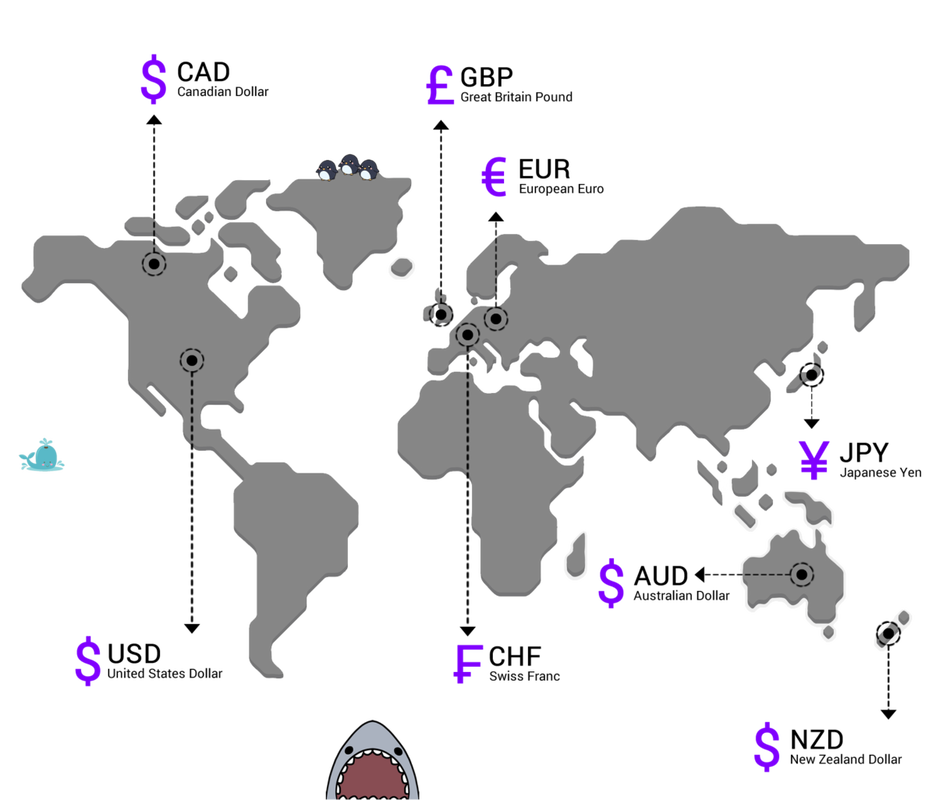

The bulk of forex trading takes place on what’s called the “interbank market“. Unlike other financial markets like the New York Stock Exchange (NYSE) or London Stock Exchange (LSE), the forex market has neither a physical location nor a central exchange. The forex market is considered an over-the-counter (OTC) market due to the fact that the entire market is run electronically, within a network of banks, continuously over a 24-hour period. This means that the FX market is spread all over the globe with no central location. Trades can take place anywhere as long as you have an Internet connection! The forex OTC market is by far the biggest and most popular financial market in the world, traded globally by a large number of individuals and organizations. In an OTC market, participants determine who they want to trade with depending on trading conditions, the attractiveness of prices, and the reputation of the trading counterparty (the other party who takes the opposite side of your trade). The chart below shows the seven most actively traded currencies. *Because two currencies are involved in each transaction, the sum of the percentage shares of individual currencies totals 200% instead of 100% The U.S. dollar is the most traded currency, making up 84.9% of all transactions! The euro’s share is second at 39.1%, while that of the yen is third at 19.0%. As you can see, most of the major currencies are hogging the top spots on this list! The Dollar is King in the Forex MarketYou’ve probably noticed how often we keep mentioning the U.S. dollar (USD). If the USD is one-half of every major currency pair, and the majors comprise 75% of all trades, then it’s a must to pay attention to the U.S. dollar. The USD is king! In fact, according to the International Monetary Fund (IMF), the U.S. dollar comprises roughly 62% of the world’s official foreign exchange reserves! Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies. Because almost every investor, business, and central bank own it, they pay attention to the U.S. dollar. There are also other significant reasons why the U.S. dollar plays a central role in the forex market:

Speculation in the Forex Market One important thing to note about the forex market is that while commercial and financial transactions are part of the trading volume, most currency trading is based on speculation. In other words, most of the trading volume comes from traders that buy and sell based on the short-term price movements of currency pairs. The trading volume brought about by speculators is estimated to be more than 90%! The scale of the forex market means that liquidity – the amount of buying and selling volume happening at any given time – is extremely high. This makes it very easy for anyone to buy and sell currencies. From the perspective of a trader, liquidity is very important because it determines how easily price can change over a given time period. A liquid market environment like forex enables huge trading volumes to happen with very little effect on the price, or price action. While the forex market is relatively very liquid, the market depth could change depending on the currency pair and time of day. In our forex trading sessions part of the School, we’ll explain how the time of your trades can affect the pair you’re trading. In the meantime, let’s learn about the different ways that individuals can trade currencies. Track Progress Forex trading is the simultaneous buying of one currency and selling another. Currencies are traded through a broker or dealer and are traded in pairs. Currencies are quoted in relation to another currency. For example, the euro and the U.S. dollar (EUR/USD) or the British pound and the Japanese yen (GBP/JPY). When you trade in the forex market, you buy or sell in currency pairs. Imagine each currency pair constantly in a “tug of war” with each currency on its own side of the rope. An exchange rate is the relative price of two currencies from two different countries. Exchange rates fluctuate based on which currency is stronger at the moment. There are three categories of currency pairs:

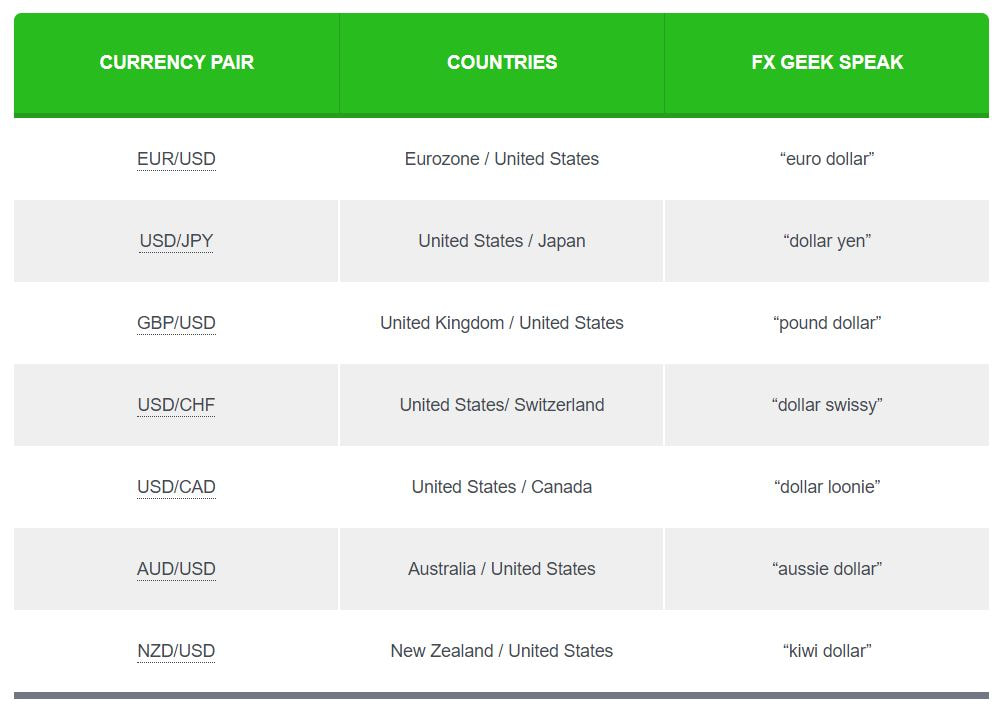

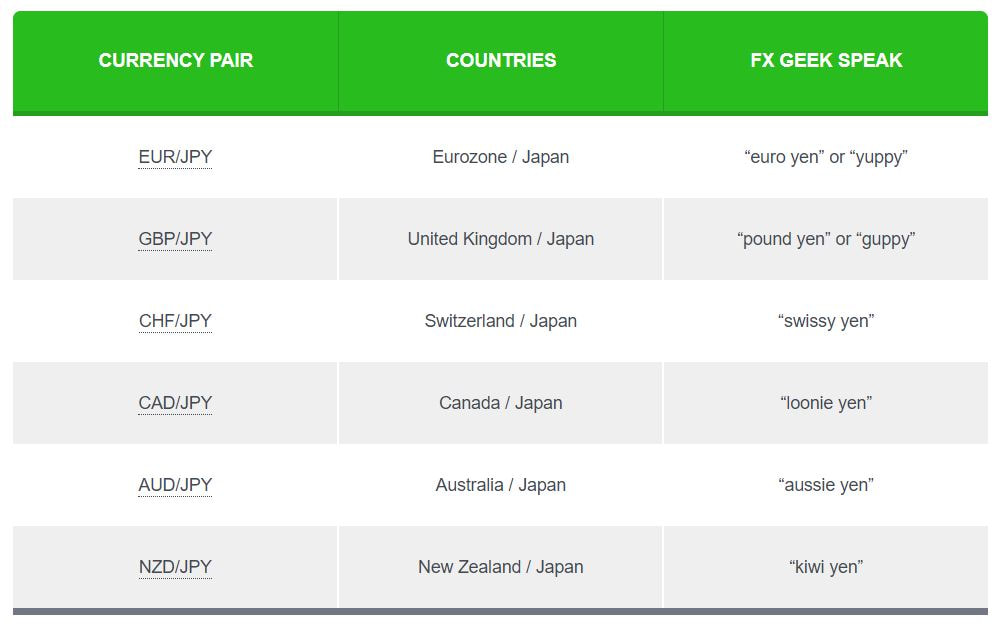

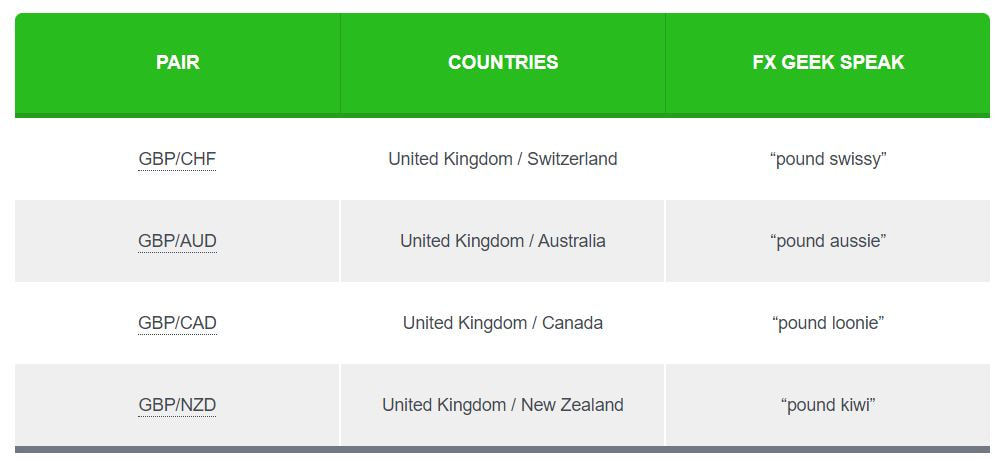

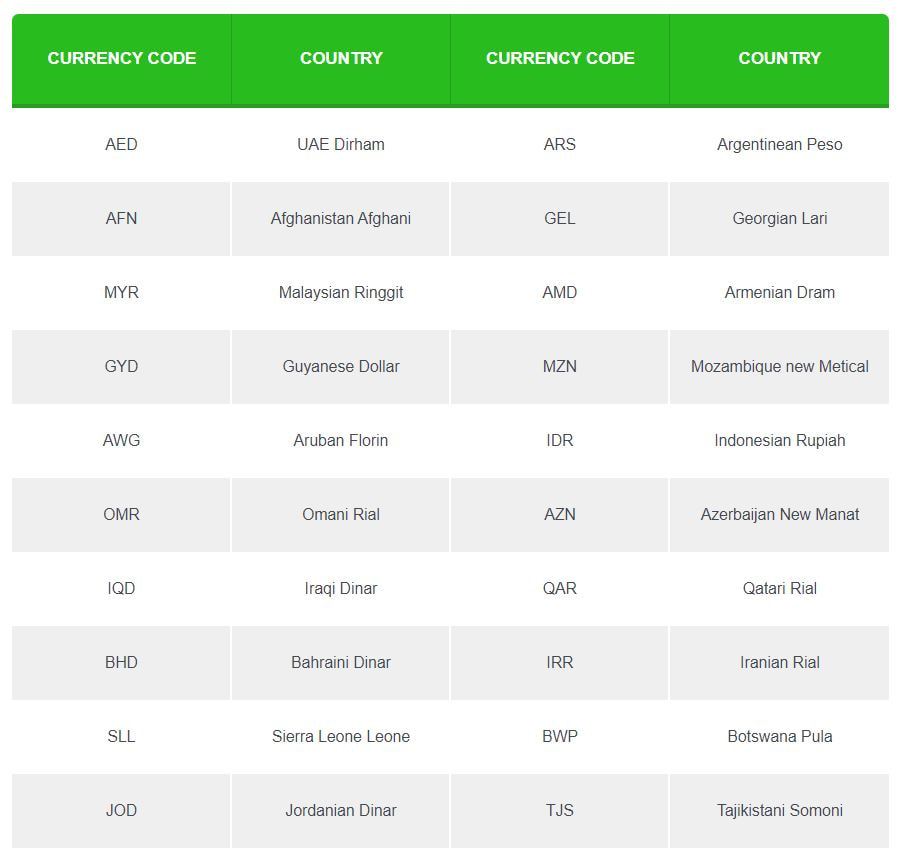

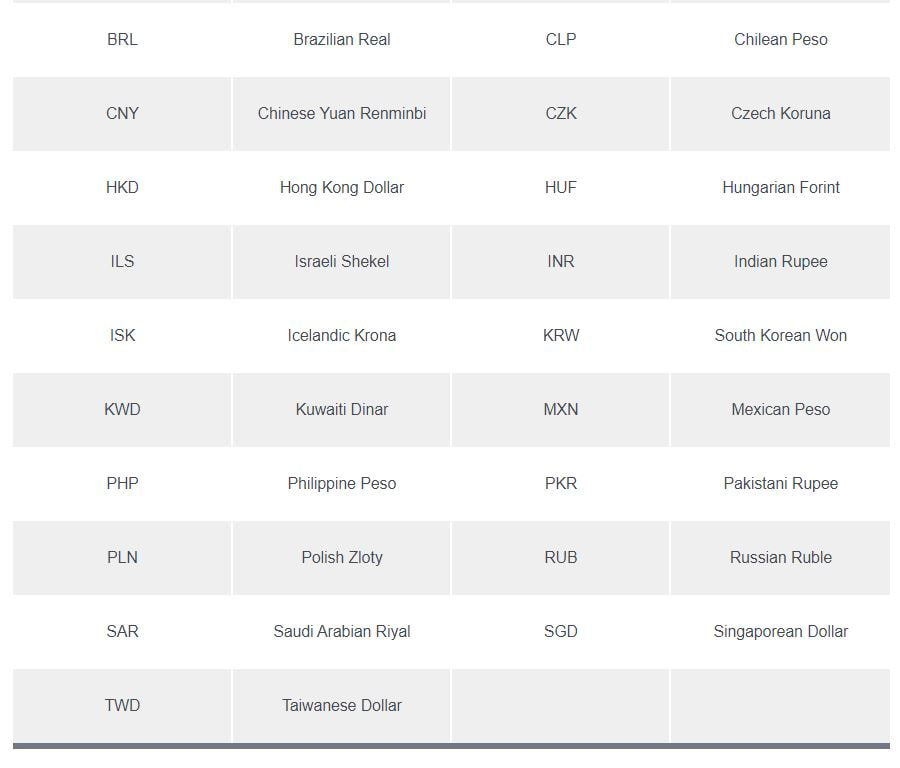

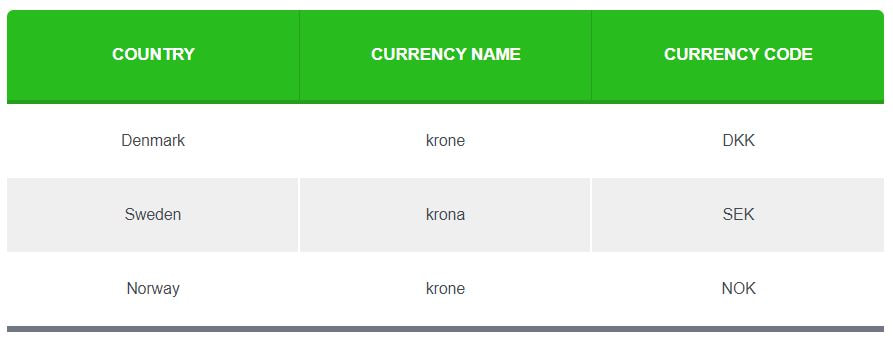

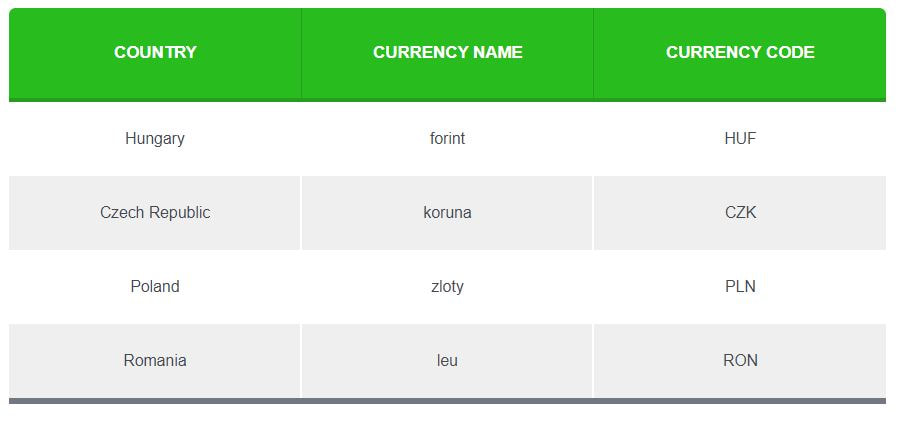

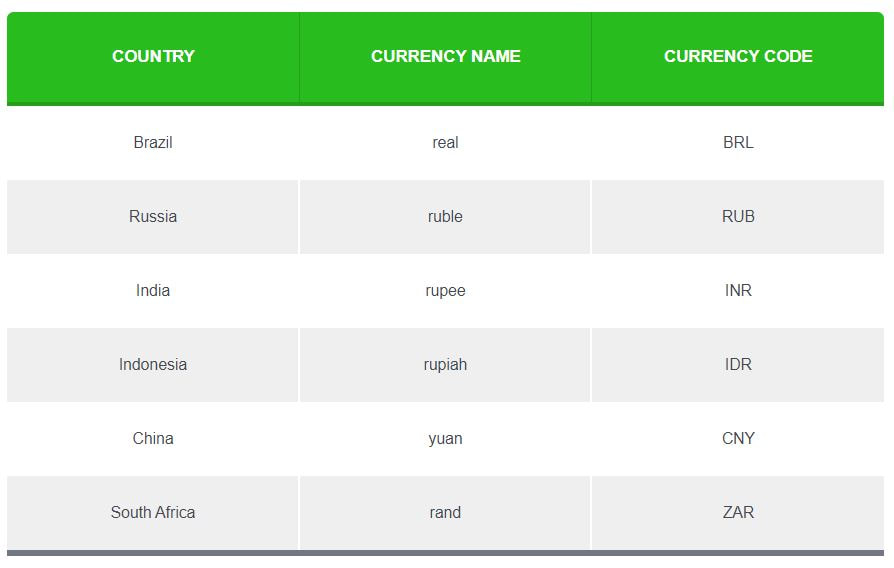

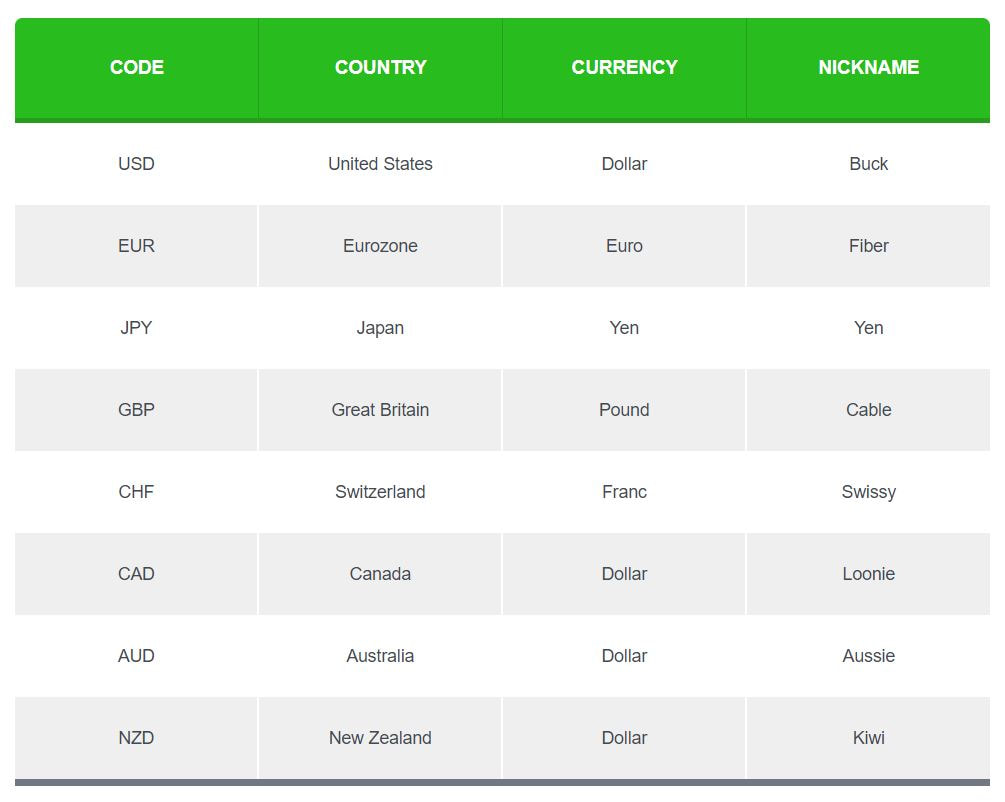

Cross-currency pairs do NOT include the U.S. dollar. Crosses that involve any of the major currencies are also known as ” minors”. Exotic currency pairs consist of one major currency and one currency from an emerging market (EM). Major Currency PairsThe currency pairs listed below are considered the “majors.” These pairs all contain the U.S. dollar (USD) on one side and are the most frequently traded. Compared to the crosses and exotics, price moves more frequently with the majors, which provide more trading opportunities. The majors are the most liquid in the world. Liquidity is used to describe the level of activity in the financial market. In forex, it’s based on the number of active traders buying and selling a specific currency pair and the volume being traded. The more frequently traded something is, the higher its liquidity. For example, more people trade the EUR/USD currency pair and at higher volumes, than the AUD/USD currency pair. This means that EUR/USD is more liquid than AUD/USD. Major Cross-Currency Pairs or Minor Currency PairsCurrency pairs that don’t contain the U.S. dollar (USD) are known as cross-currency pairs or simply as the “crosses.” Major crosses are also known as “minors.” While not as frequently traded as the majors, the crosses are still pretty liquid and still provide plenty of trading opportunities. The most actively traded crosses are derived from the three major non-USD currencies: EUR, JPY, and GBP. Euro CrossesYen CrossesPound CrossesOther CrossesExotic Currency PairsNo, exotic pairs are not exotic belly dancers who happen to be twins. Exotic currency pairs are made up of one major currency paired with the currency of an emerging economy, such as Brazil, Mexico, Chile, Turkey, or Hungary. The chart below contains a few examples of exotic currency pairs. Wanna take a shot at guessing what those other currency symbols stand for? Depending on your forex broker, you may see the following exotic currency pairs so it’s good to know what they are. Keep in mind that these pairs aren’t as heavily traded as the “majors” or “crosses,” so the transaction costs associated with trading these pairs are usually bigger. It’s not unusual to see spreads that are two or three times bigger than that of EUR/USD or USD/JPY. Due to the overall lower degree of liquidity, exotic currency pairs tend to be far more sensitive to economic and geopolitical events. For example, a political scandal or unexpected election results can cause an exotic pair’s exchange rate to swing violently. So if you want to trade exotics currency pairs, remember to factor this in your decision. For those of y’all who are really mesmerized by exotics, here’s a more comprehensive list. Aside from the three main categories of currency pairs, there are other “groups” of currencies that are thrown around in the FX world which you should be aware of. G10 CurrenciesThe G10 currencies are ten of the most heavily traded currencies in the world, which are also ten of the world’s most liquid currencies. Traders regularly buy and sell them in an open market with minimal impact on their own international exchange rates. The ScandiesScandinavia is a subregion in Northern Europe, with strong historical, cultural, and linguistic ties. The term “Scandinavia” in local usage covers the three kingdoms of Denmark, Norway, and Sweden. Together, their currencies are known as the “Scandies“. Back in the day, Denmark and Sweden established the Scandinavian Monetary Union to merge their currencies to a gold standard. Norway joined later. This meant that these countries now had one currency, with the same monetary value, with the exception that each of these countries minted their own coins. But then World War I happened, and the gold standard was abandoned and the Scandinavian Monetary Union disbanded. These countries decided to keep the currency, even if the values were separate from one another. And this remains the state of things. If you notice their currency names, they all look similar. That’s because the word “krone or krona” literally means “crown”, and the differences in spelling of the name represent the differences between the North Germanic languages. Crown currencies. What a cool name huh? I don’t know about you, but saying “Hook me up with some crowns yo.” sounds way cooler than “Hook me up with some dollahs yo.” SEK and NOK also have cool nicknames, “Stockie” and “Nokie“. So when paired with the U.S. dollar, USD/SEK is read “dollar stockie” and USD/NOK is read “dollar nockie”. CEE Currencies“CEE” stands for Central and Eastern Europe. Central and Eastern Europe is a term encompassing the countries in Central Europe, the Baltics, Eastern Europe, and Southeast Europe (the Balkans), usually meaning former communist states from the Eastern Bloc (Warsaw Pact) in Europe. Central and Eastern European Countries (CEECs) is an OECD term for the group of countries comprising Albania, Bulgaria, Croatia, the Czech Republic, Hungary, Poland, Romania, the Slovak Republic, Slovenia, and the three Baltic States: Estonia, Latvia, and Lithuania. Regarding the FX market, there are four main CEE currencies to be aware of. BRIICSBRIICS is the acronym coined for the association of five major emerging national economies: Brazil, Russia, India, Indonesia, China, and South Africa. Originally the first four were grouped as “BRIC” (or “the BRICs”). BRICs was a term created by Goldman Sachs to name today’s new high-growth emerging economies. BRIICS is the term created by the OECD, when it added Indonesia and South Africa. SummaryWhew! That was a lot of information on currencies but you just raised your FX IQ points! 🧠

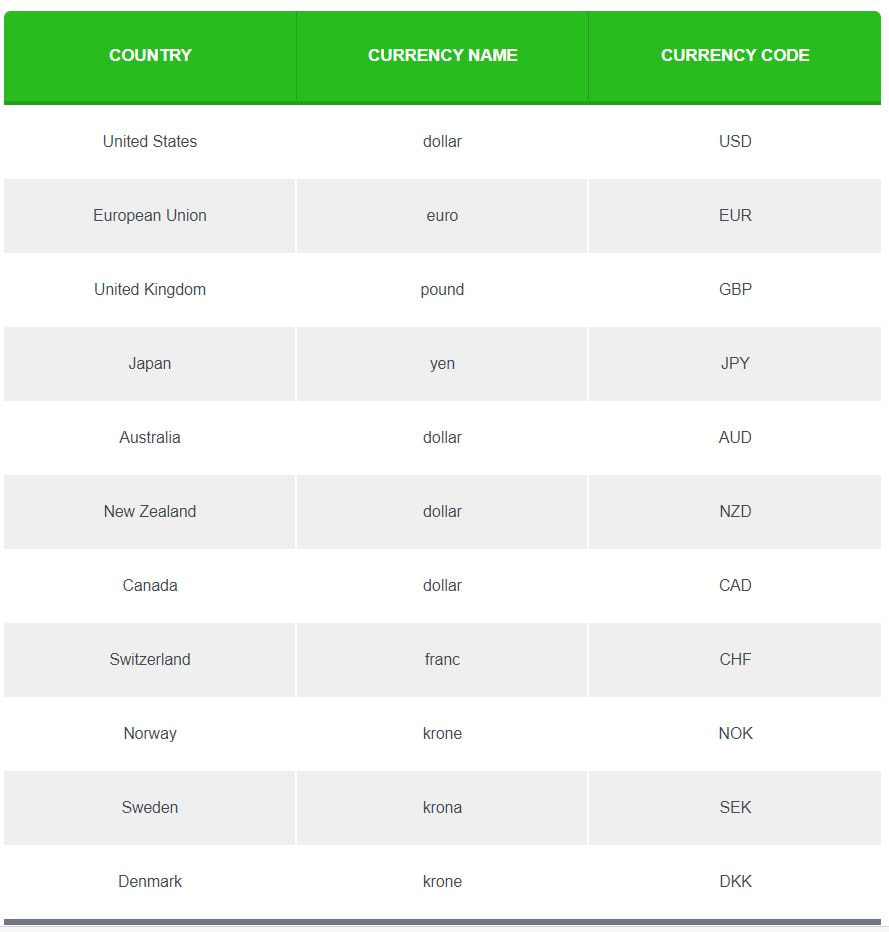

Let’s summarize what you’ve learned in a series of questions: What is a currency pair in forex? A currency pair is a pairing of currencies where the value of one is relative to the other. For example, GBP/USD is the value of the British pound relative to the U.S. dollar. What are the major currency pairs? Major currency pairs (“majors”) are those that include the U.S. dollar and the most frequently traded. There are seven of them: EUR/USD, USD/JPY, GBPUSD, USD/CAD, USD/CHF, AUD/USD, and NZD/USD. What are the currency crosses? Currency crosses (“crosses”) are the more frequently traded currencies that do NOT include the U.S. dollar in their pairing. Crosses include EUR/GBP, EUR/CAD, GBP/JPY, EUR/CHF, EUR/JPY, etc. How many currency pairs exist? There are HUNDREDS of currency pairs in existence but not all can be traded in the FX market. The United Nations currently recognizes 180 currencies. If you were to pair each currency up with another, it’s a lot. What is traded in forex? The simple answer is MONEY. Because you’re not buying anything physical, forex trading can be confusing so we’ll use a simple (but imperfect) analogy to help explain. Think of buying a currency as buying a share in a particular country, kinda like buying shares in a company. The price of the currency is usually a direct reflection of the market’s opinion on the current and future health of its respective economy. In forex trading, when you buy, say, the Japanese yen, you are basically buying a “share” in the Japanese economy. You are betting that the Japanese economy is doing well, and will even get better as time goes. Once you sell those “shares” back to the market, hopefully, you will end up with a profit. In general, the exchange rate of a currency versus other currencies is a reflection of the condition of that country’s economy, compared to other countries’ economies. By the time you graduate from this School of Pipsology, you’ll be eager to start working with currencies. Major CurrenciesWhile there are potentially lots of currencies you can trade, as a new forex trader, you will probably start trading with the “major currencies“. They’re called “major currencies” because they’re the most heavily traded currencies and represent some of the world’s largest economies. Forex traders differ on what they consider as “major currencies”. The uptight ones who probably got straight A’s and followed all the rules as children only consider USD, EUR, JPY, GBP, and CHF as major currencies. Then they label AUD, NZD, and CAD as “commodity currencies“. For us rebels, and to keep things simple, we just consider all eight currencies as the “majors”. Below, we list them by their symbol, country where they’re used, currency name, and cool nicknames. Currency symbols always have three letters, where the first two letters identify the name of the country and the third letter identifies the name of that country’s currency, usually the first letter of the currency’s name. These three letters are known as ISO 4217 Currency Codes. By 1973, the International Organization for Standardization (ISO) established the three-letter codes for currencies that we use today. Take NZD for instance… NZ stands for New Zealand, while D stands for dollar. Easy enough, right? The currencies included in the chart above are called the “majors” because they are the most widely traded ones. We’d also like to let you know that “buck” isn’t the only nickname for USD. There’s also: greenbacks, bones, benjis, benjamins, cheddar, paper, loot, scrilla, cheese, bread, moolah, dead presidents, and cash money. So, if you wanted to say, “I have to go to work now.” Instead, you could say, “Yo, I gotta bounce! Gotta make them benjis son!” FUN FACT: In Peru, a nickname for the U.S. dollar is Coco, which is a pet name for Jorge (George in Spanish), a reference to the portrait of George Washington on the $1 note? They call me Coco yo! SOURCE: BABYPIPS.COM

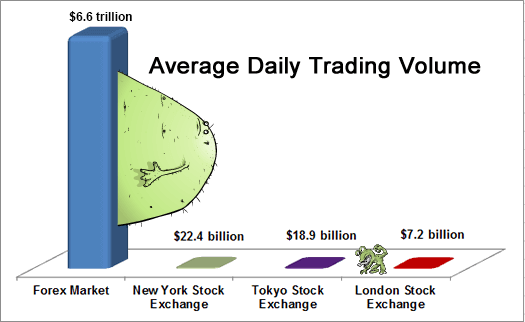

What is forex? Quite simply, it’s the global market that allows one to trade two currencies against each other. If you think one currency will be stronger versus the other, and you end up correct, then you can make a profit. If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting. You go up to the counter and notice a screen displaying different exchange rates for different currencies. An exchange rate is the relative price of two currencies from two different countries. You find “Japanese yen” and think to yourself, “WOW! My one dollar is worth 100 yen?! And I have ten dollars! I’m going to be rich!!!” When you do this, you’ve essentially participated in the forex market! You’ve exchanged one currency for another. Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen. Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is expensive!) and notice the exchange rates have changed. It’s these changes in the exchange rates that allow you to make money in the foreign exchange market. What is forex?The foreign exchange market, which is usually known as “forex” or “FX,” is the largest financial market in the world. The FX market is a global, decentralized market where the world’s currencies change hands. Exchange rates change by the second so the market is constantly in flux. Only a tiny percentage of currency transactions happen in the “real economy” involving international trade and tourism like the airport example above. Instead, most of the currency transactions that occur in the global foreign exchange market are bought (and sold) for speculative reasons. Currency traders (also known as currency speculators) buy currencies hoping that they will be able to sell them at a higher price in the future. Compared to the “measly” $22.4 billion per day volume of the New York Stock Exchange (NYSE), the foreign exchange market looks absolutely ginormous with its $6.6 TRILLION a day trade volume. That’s trillion with a “t”. Let’s take a moment to put this into perspective using monsters… The largest stock market in the world, the New York Stock Exchange (NYSE), trades a volume of about $22.4 billion each day. If we used a monster to represent the NYSE, it would look like this… Oooh, the NYSE looks so puny compared to the forex market! It doesn’t stand a chance! Makes if you wonder if the “S” in NYSE stands for “Stock” or for “Scrawny”? 🤣 Check out the graph of the average daily trading volume for the forex market, New York Stock Exchange, Tokyo Stock Exchange, and London Stock Exchange: The currency market is over 200 times BIGGER! It is HUGE! But hold your horses, there’s a catch! That huge $6.6 trillion number covers the entire global foreign exchange market, BUT the “spot” market, which is the part of the currency market that’s relevant to most forex traders is smaller at $2 trillion per day. And then, if you just want to count the daily trading volume from retail traders (that’s us), it’s even smaller. It is very difficult to determine the exact size of the retail segment of the FX market, but it’s estimated to be around 3-5% of overall daily FX trading volumes, or around $200-300 billion (maybe less). So you see, the forex market is definitely huge, but not as huge as the others would like you to believe. Don’t believe the “forex is a $6.6 trillion market” hype! The huge number sounds impressive, but a bit misleading. We don’t like to exaggerate. We just keepin’ it real. Aside from its size, the market also rarely closes! It’s open virtually round the clock. The forex market is open 24 hours a day and 5 days a week, only closing down during the weekend. (What a bunch of slackers!) So unlike the stock or bond markets, the forex market does NOT close at the end of each business day. Instead, trading just shifts to different financial centers around the world. The day starts when traders wake up in Auckland/Wellington, then moves to Sydney, Singapore, Hong Kong, Tokyo, Frankfurt, London, and finally, New York, before trading starts all over again in Wellington! In the next section, we’ll reveal WHAT exactly is traded in the forex market. SOURCE: BABYPIPS.COM

|

INFIN8ETVWe bring infinite possibilities to our community. ArchivesCategories |

TEAM INFIN8E © 2015

IMPORTANT DISCLAIMER: This website is intended for education purposes only. We are not financial advisor. All content provided herein our website, hyperlinked sites, associated applications, forums, blogs, social media accounts and other platforms (“Site”) is for your general information only, procured from third party sources. We make no warranties of any kind in relation to our content, including but not limited to accuracy and updatedness.

RSS Feed

RSS Feed