|

As in any new skill that you learn, you need to learn the lingo… especially if you wish to win your love’s heart. You, the newbie, must know certain terms like the back of your hand before making your first trade. Some of these terms you’ve already learned, but it never hurts to do a little review. Major and Minor CurrenciesThe eight most frequently traded currencies (USD, EUR, JPY, GBP, CHF, CAD, NZD, and AUD) are called the major currencies or the “majors.” These are the most liquid and the most sexy. All other currencies are referred to as minor currencies. Base CurrencyThe base currency is the first currency in any currency pair. The currency quote shows how much the base currency is worth as measured against the second currency. For example, if the USD/CHF rate equals 1.6350, then one USD is worth CHF 1.6350. In the forex market, the U.S. dollar is normally considered the “base” currency for quotes, meaning that quotes are expressed as a unit of 1 USD per the other currency quoted in the pair. The primary exceptions to this rule are the British pound, the euro, and the Australian and New Zealand dollar. Quote CurrencyThe quote currency is the second currency in any currency pair. This is frequently called the pip currency and any unrealized profit or loss is expressed in this currency. PipA pip is the smallest unit of price for any currency. Nearly all currency pairs consist of five significant digits and most pairs have the decimal point immediately after the first digit, that is, EUR/USD equals 1.2538. In this instance, a single pip equals the smallest change in the fourth decimal place – that is, 0.0001. Therefore, if the quote currency in any pair is USD, then one pip always equals 1/100 of a cent. Notable exceptions are pairs that include the Japanese yen where a pip equals 0.01. PipetteOne-tenth of a pip. Some brokers quote fractional pips, or pipettes, for added precision in quoting rates. For example, if EUR/USD moved from 1.32156 to 1.32158, it moved 2 pipettes. Bid PriceThe bid is the price at which the market is prepared to buy a specific currency pair in the forex market. At this price, the trader can sell the base currency. It is shown on the left side of the quotation. For example, in the quote GBP/USD 1.8812/15, the bid price is 1.8812. This means you sell one British pound for 1.8812 U.S. dollars. Ask/Offer PriceThe ask/offer is the price at which the market is prepared to sell a specific currency pair in the forex market. At this price, you can buy the base currency. It is shown on the right side of the quotation. For example, in the quote EUR/USD 1.2812/15, the ask price is 1.2815. This means you can buy one euro for 1.2815 U.S. dollars. The ask price is also known as the offer price. Bid-Ask SpreadThe spread is the difference between the bid and ask price. The “big figure quote” is the dealer expression referring to the first few digits of an exchange rate. These digits are often omitted in dealer quotes. For example, the USD/JPY rate might be 118.30/118.34, but would be quoted verbally without the first three digits as “30/34.” In this example, USD/JPY has a 4-pip spread. Quote ConventionExchange rates in the forex market are expressed using the following format: Base currency / Quote currency = Bid / Ask Transaction CostThe critical characteristic of the bid/ask spread is that it is also the transaction cost for a round-turn trade. Round-turn means a buy (or sell) trade and an offsetting sell (or buy) trade of the same size in the same currency pair. For example, in the case of the EUR/USD rate of 1.2812/15, the transaction cost is three pips. The formula for calculating the transaction cost is: Transaction cost (spread) = Ask Price – Bid Price Cross CurrencyA cross-currency is any currency pair in which neither currency is the U.S. dollar. These pairs exhibit erratic price behavior since the trader has, in effect, initiated two USD trades. For example, initiating a long (buy) EUR/GBP is equivalent to buying a EUR/USD currency pair and selling GBP/USD. Cross-currency pairs frequently carry a higher transaction cost. MarginWhen you open a new margin account with a forex broker, you must deposit a minimum amount with that broker. This minimum varies from broker to broker and can be as low as $100 to as high as $100,000. Each time you execute a new trade, a certain percentage of the account balance in the margin account will be set aside as the initial margin requirement for the new trade. The amount is based upon the underlying currency pair, its current price, and the number of units (or lots) traded. The lot size always refers to the base currency. For example, let’s say you open a mini account that provides a 200:1 leverage or 0.5% margin. Mini accounts trade mini lots. Let’s say one mini lot equals $10,000. If you were to open one mini-lot, instead of having to provide the full $10,000, you would only need $50 ($10,000 x 0.5% = $50). LeverageLeverage is the ratio of the amount capital used in a transaction to the required security deposit ( the “margin“).

It is the ability to control large dollar amounts of a financial instrument with a relatively small amount of capital. Leverage varies dramatically with different brokers, ranging from 2:1 to 500:1. Now that you’ve impressed your dates with your forex lingo, how about showing them the different types of trade orders?

0 Comments

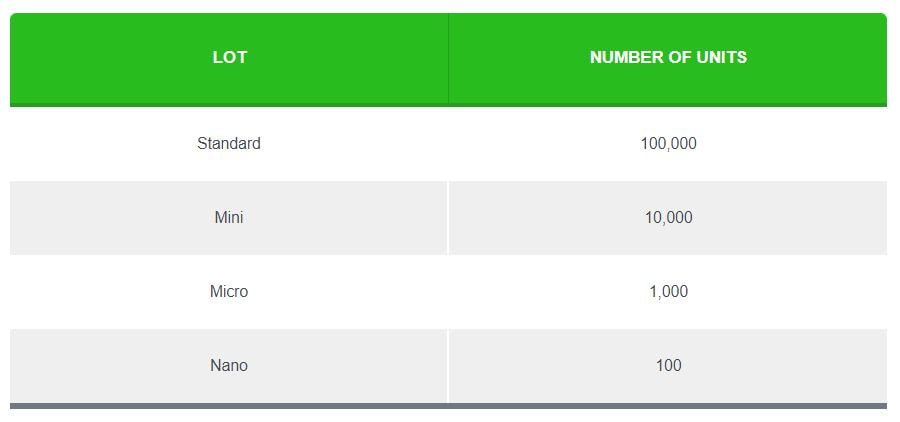

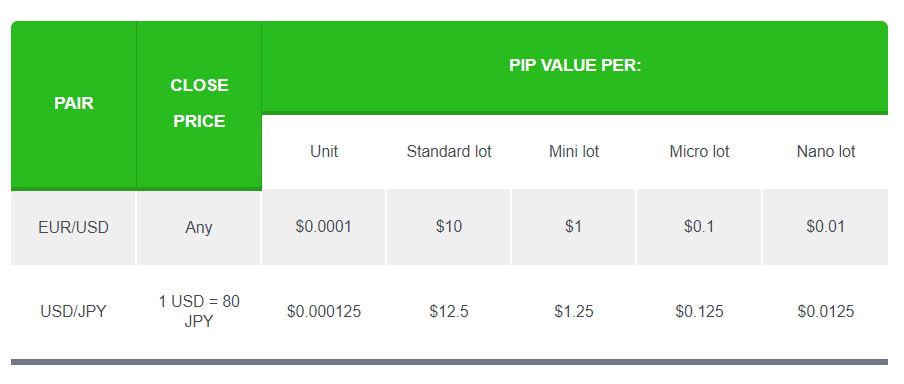

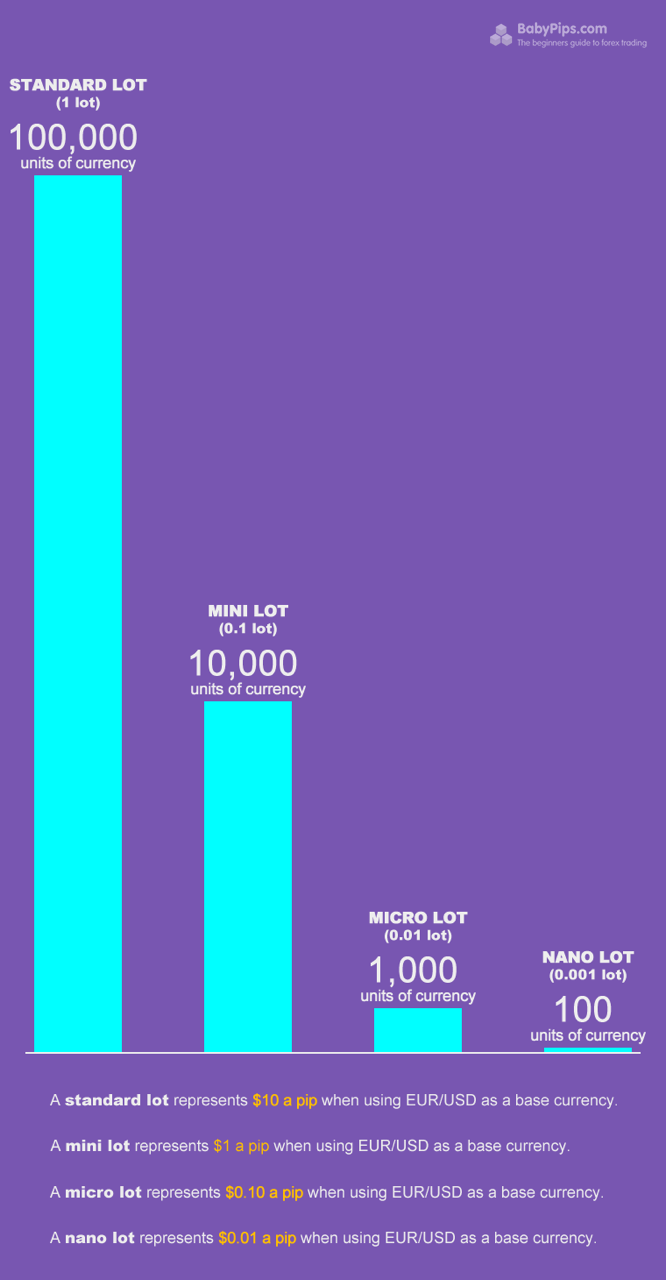

Forex is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell. The standard size for a lot is 100,000 units of currency, and now, there are also mini, micro, and nano lot sizes that are 10,000, 1,000, and 100 units. Some brokers show quantity in “lots”, while other brokers show the actual currency units. As you may already know, the change in a currency value relative to another is measured in “pips,” which is a very, very small percentage of a unit of currency’s value. To take advantage of this minute change in value, you need to trade large amounts of a particular currency in order to see any significant profit or loss. Let’s assume we will be using a 100,000 unit (standard) lot size. We will now recalculate some examples to see how it affects the pip value.

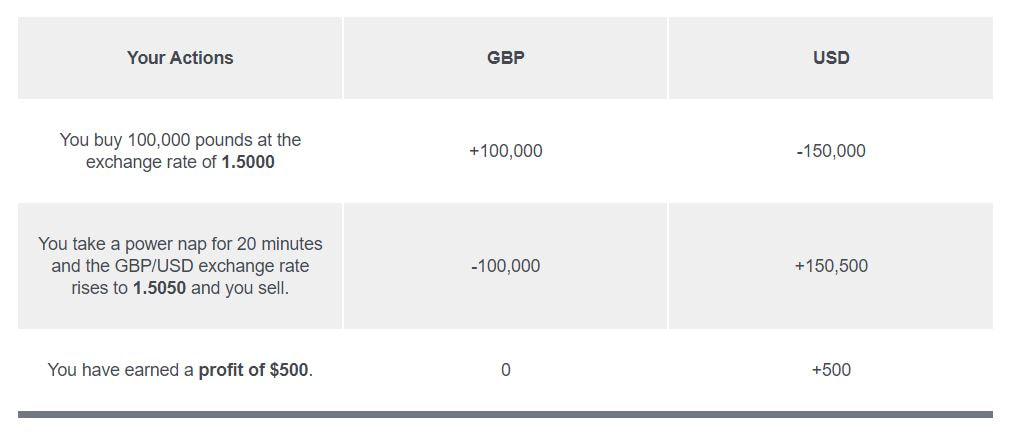

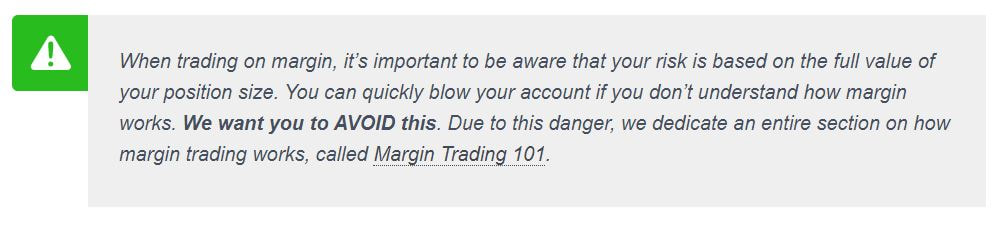

Here are examples of pip values for EUR/USD and USD/JPY, depending on lot size. Your broker may have a different convention for calculating pip values relative to lot size but whatever way they do it, they’ll be able to tell you what the pip value is for the currency you are trading at that particular time. In other words, they do all the math calculations for you! As the market moves, so will the pip value depending on what currency you are currently trading. What the heck is leverage?You are probably wondering how a small investor like yourself can trade such large amounts of money. Think of your broker as a bank who basically fronts you $100,000 to buy currencies. All the bank asks from you is that you give it $1,000 as a good faith deposit, which it will hold for you but not necessarily keep. Sounds too good to be true? This is how forex trading using leverage works. The amount of leverage you use will depend on your broker and what you feel comfortable with. Typically the broker will require a deposit, also known as “margin“. Once you have deposited your money, you will then be able to trade. The broker will also specify how much margin is required per position (lot) traded. For example, if the allowed leverage is 100:1 (or 1% of position required), and you wanted to trade a position worth $100,000, but you only have $5,000 in your account. No problem as your broker would set aside $1,000 as a deposit and let you “borrow” the rest. Of course, any losses or gains will be deducted or added to the remaining cash balance in your account. The minimum security (margin) for each lot will vary from broker to broker. In the example above, the broker required a 1% margin. This means that for every $100,000 traded, the broker wants $1,000 as a deposit on the position. Let’s say you want to buy 1 standard lot (100,000) of USD/JPY. If your account is allowed 100:1 leverage, you will have to put up $1,000 as margin. The $1,000 is NOT a fee, it’s a deposit. You get it back when you close your trade. The reason the broker requires the deposit is that while the trade is open, there’s the risk that you could lose money on the position! Assuming that this USD/JPY trade is the only position you have open in your account, you would have to maintain your account’s equity (absolute value of your trading account) of at least $1,000 at all times in order to be allowed to keep the trade open. If USD/JPY plummets and your trading losses cause your account equity to fall below $1,000, the broker’s system would automatically close out your trade to prevent further losses. This is a safety mechanism to prevent your account balance from going negative. Understanding how margin trading works is so important that we have dedicated a whole section to it later in the School. It is a must-read if you don’t want to blow up your account! Moving on for now… How the heck do I calculate profit and loss?So now that you know how to calculate pip value and leverage, let’s look at how you calculate your profit or loss. Let’s buy U.S. dollars and sell Swiss francs.

Bid/Ask SpreadRemember, when you enter or exit a trade, you are subject to the spread in the bid/ask quote.

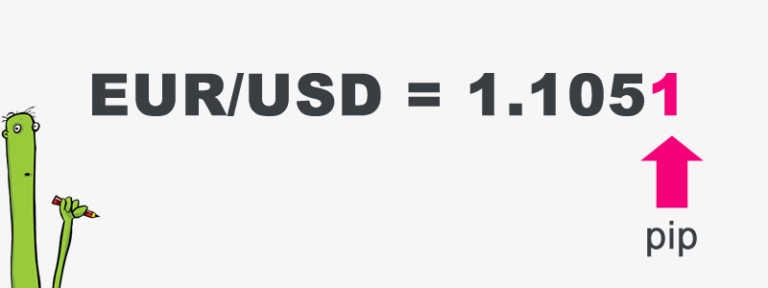

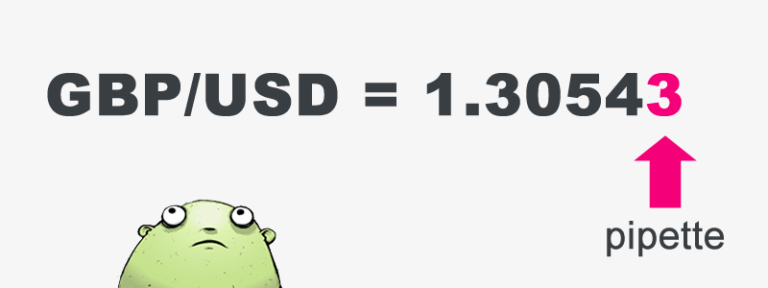

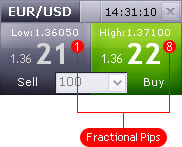

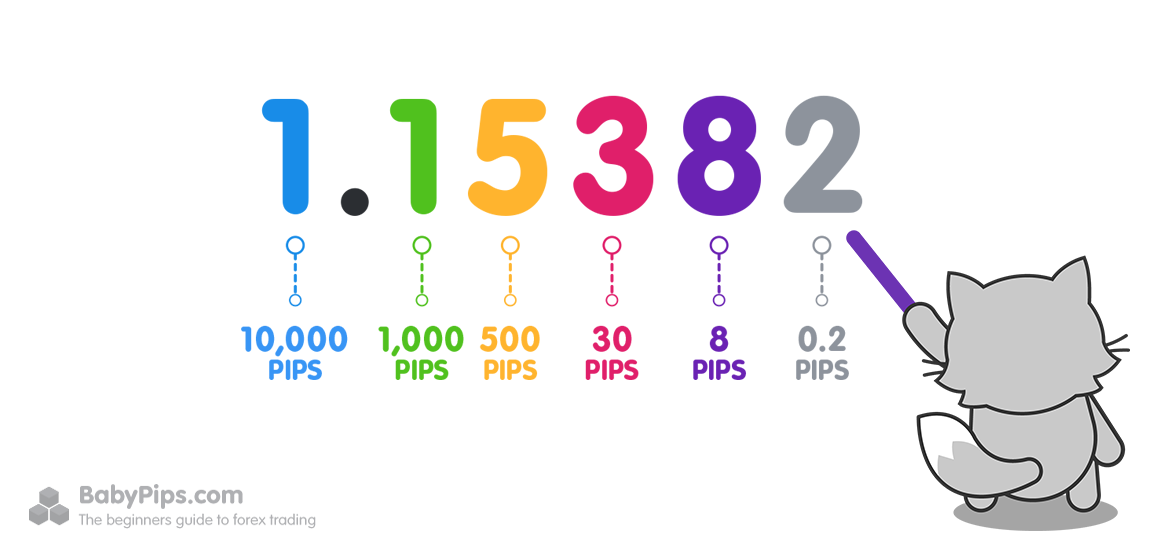

When you buy a currency, you will use the offer or ASK price. When you sell, you will use the BID price. Next up, we’ll give you a roundup of the freshest forex lingos you’ve learned! Here is where we’re going to do a little math. Just a little bit. You’ve probably heard of the terms “pips,” “points“, “pipettes,” and “lots” thrown around, and now we’re going to explain what they are and show you how their values are calculated. Take your time with this information, as it is required knowledge for all forex traders. Don’t even think about trading until you are comfortable with pip values and calculating profit and loss. What the heck is a Pip?The unit of measurement to express the change in value between two currencies is called a “pip.” If EUR/USD moves from 1.1050 to 1.1051, that .0001 USD rise in value is ONE PIP. A pip is usually the last decimal place of a price quote. Most pairs go out to 4 decimal places, but there are some exceptions like Japanese yen pairs (they go out to two decimal places). For example, for EUR/USD, it is 0.0001, and for USD/JPY, it is 0.01. What is a Pipette?There are forex brokers that quote currency pairs beyond the standard “4 and 2” decimal places to “5 and 3” decimal places. They are quoting FRACTIONAL PIPS, also called “points” or “pipettes.” If the concept of a “pip” isn’t already confusing enough for the new forex trader, let’s try to make you even more confused and point out that a “point” or “pipette” or “fractional pip” is equal to a “tenth of a pip“. For instance, if GBP/USD moves from 1.30542 to 1.30543, that .00001 USD move higher is ONE PIPETTE. Here’s how fractional pips look like on a trading platform: On trading platforms, the digit representing a tenth of a pip usually appears to the right of the two larger digits. Here’s a pip “map” to help you to learn how to read pips… How to Calculate the Value of a PipAs each currency has its own relative value, it’s necessary to calculate the value of a pip for that particular currency pair. In the following example, we will use a quote with 4 decimal places. For the purpose of better explaining the calculations, exchange rates will be expressed as a ratio (i.e., EUR/USD at 1.2500 will be written as “1 EUR / 1.2500 USD”) Example #1: USD/CAD = 1.0200To be read as 1 USD to 1.0200 CAD (or 1 USD/1.0200 CAD) (The value change in counter currency) times the exchange rate ratio = pip value (in terms of the base currency) [.0001 CAD] x [1 USD/1.0200 CAD] Or simply as: [(.0001 CAD) / (1.0200 CAD)] x 1 USD = 0.00009804 USD per unit traded Using this example, if we traded 10,000 units of USD/CAD, then a one pip change to the exchange rate would be approximately a 0.98 USD change in the position value (10,000 units x 0.00009804 USD/unit). We say “approximately” because as the exchange rate changes, so does the value of each pip move. Example #2: GBP/JPY = 123.00Here’s another example using a currency pair with the Japanese Yen as the counter currency. Notice that this currency pair only goes to two decimal places to measure a 1 pip change in value (most of the other currencies have four decimal places). In this case, a one pip move would be .01 JPY. (The value change in counter currency) times the exchange rate ratio = pip value (in terms of the base currency) [.01 JPY] x [1 GBP/123.00 JPY] Or simply as: [(.01 JPY) / (123.00 JPY)] x 1 GBP = 0.0000813 GBP So, when trading 10,000 units of GBP/JPY, each pip change in value is worth approximately 0.813 GBP. How to Find the Pip Value in Your Trading Account’s CurrencyThe final question to ask when figuring out the pip value of your position is, “What is the pip value in terms of my trading account’s currency?”

After all, it is a global market and not everyone has their account denominated in the same currency. This means that the pip value will have to be translated to whatever currency our account may be traded in. This calculation is probably the easiest of all; simply multiply/divide the “found pip value” by the exchange rate of your account currency and the currency in question. If the “found pip value” currency is the same currency as the base currency in the exchange rate quote: Using the GBP/JPY example above, let’s convert the found pip value of .813 GBP to the pip value in USD by using GBP/USD at 1.5590 as our exchange rate ratio. If the currency you are converting to is the counter currency of the exchange rate, all you have to do is divide the “found pip value” by the corresponding exchange rate ratio: .813 GBP per pip / (1 GBP/1.5590 USD) Or [(.813 GBP) / (1 GBP)] x (1.5590 USD) = 1.2674 USD per pip move So, for every .01 pip move in GBP/JPY, the value of a 10,000 unit position changes by approximately 1.27 USD. If the currency you are converting to is the base currency of the conversion exchange rate ratio, then multiply the “found pip value” by the conversion exchange rate ratio. Using our USD/CAD example above, we want to find the pip value of .98 USD in New Zealand Dollars. We’ll use .7900 as our conversion exchange rate ratio: 0.98 USD per pip X (1 NZD/.7900 USD) Or [(0.98 USD) / (.7900 USD)] x (1 NZD) = 1.2405 NZD per pip move For every .0001 pip move in USD/CAD from the example above, your 10,000 unit position changes in value by approximately 1.24 NZD. Even though you’re now a math genius–at least with pip values–you’re probably rolling your eyes back and thinking, “Do I really need to work all this out?” Well, the answer is a big fat NO. Nearly all forex brokers will work all this out for you automatically, but it’s always good for you to know how they work it out. If your broker doesn’t happen to do this, don’t worry! You can use our Pip Value Calculator! Aren’t we awesome?! In the next lesson, we will discuss how these seemingly insignificant amounts can add up. Forex trading involves trying to predict which currency will rise or fall versus another currency. How do you know when to buy or sell a currency pair? In the following examples, we are going to use a little fundamental analysis to help us decide whether to buy or sell a specific currency pair. The supply and demand for a currency changes due to various economic factors, which drives currency exchange rates up and down. Each currency belongs to a country (or region). So forex fundamental analysis focuses on the overall state of the country’s economy, such as productivity, employment, manufacturing, international trade, and interest ratezzzzzzzz. Wake up! If you always fell asleep during your economics class or just flat out skipped economics class, don’t worry! We will cover fundamental analysis in a later lesson. But right now, try to pretend you know what’s going on… EUR/USDIn this example, the euro is the base currency and thus the “basis” for the buy/sell. If you believe that the U.S. economy will continue to weaken, which is bad for the U.S. dollar, you would execute a BUY EUR/USD order. By doing so, you have bought euros in the expectation that it will rise versus the U.S. dollar. If you believe that the U.S. economy is strong and the euro will weaken against the U.S. dollar, you would execute a SELL EUR/USD order. By doing so, you have sold euros in the expectation that it will fall versus the US dollar. USD/JPYIn this example, the U.S. dollar is the base currency and thus the “basis” for the buy/sell. If you think that the Japanese government is going to weaken the yen in order to help its export industry, you would execute a BUY USD/JPY order. By doing so you have bought U.S dollars in the expectation that it will rise versus the Japanese yen. If you believe that Japanese investors are pulling money out of U.S. financial markets and converting all their U.S. dollars back to yen, and this will hurt the U.S. dollar, you would execute a SELL USD/JPY order. By doing so you have sold U.S dollars in the expectation that it will depreciate against the Japanese yen. GBP/USDIn this example, the pound is the base currency and thus the “basis” for the buy/sell. If you think the British economy will continue to do better than the U.S. in terms of economic growth, you would execute a BUY GBP/USD order. By doing so you have bought pounds in the expectation that it will rise versus the U.S. dollar. If you believe the British economy is slowing while the American economy remains strong like Chuck Norris, you would execute a SELL GBP/USD order. By doing so you have sold pounds in the expectation that it will depreciate against the U.S. dollar. How to trade forex with USD/CHFIn this example, the U.S. dollar is the base currency and thus the “basis” for the buy/sell. If you think the Swiss franc is overvalued, you would execute a BUY USD/CHF order. By doing so you have bought U.S. dollars in the expectation that it will appreciate versus the Swiss Franc. If you believe that the U.S. housing market weakness will hurt future economic growth, which will weaken the dollar, you would execute a SELL USD/CHF order. By doing so, you have sold U.S. dollars in the expectation that it will depreciate against the Swiss franc. Trading in “Lots”When you go to the grocery store and want to buy an egg, you can’t just buy a single egg, they come in dozens or “lots” of 12. In forex, it would be just as foolish to buy or sell 1 euro, so they usually come in “lots” of 1,000 units of currency (micro lot), 10,000 units (mini lot), or 100,000 units (standard lot) depending on your broker and the type of account you have (more on “lots” later). Margin Trading“But I don’t have enough money to buy 10,000 euros! Can I still trade?” You can! By using leverage. When you trade with leverage, you wouldn’t need to pay the 10,000 euros upfront. Instead, you’d put down a small “deposit”, known as margin. Leverage is the ratio of the transaction size (“position size”) to the actual cash (“trading capital”) used for margin. For example, 50:1 leverage, also known as a 2% margin requirement, means $2,000 of margin is required to open a position size worth $100,000. Margin trading lets you open large position sizes using only a fraction of the capital you’d normally need. This is how you’re able to open $1,250 or $50,000 positions with as little as $25 or $1,000. You can conduct relatively large transactions with a small amount of initial capital. Let us explain. We will be discussing margin in more detail later, but hopefully, you’re able to get the basic idea of how it works. Listen carefully because this is very important!

When you decide to close a position, the deposit (“margin”) that you originally made is returned to you and a calculation of your profits or losses is done. This profit or loss is then credited to your account. Let’s review the GBP/USD trade example above.

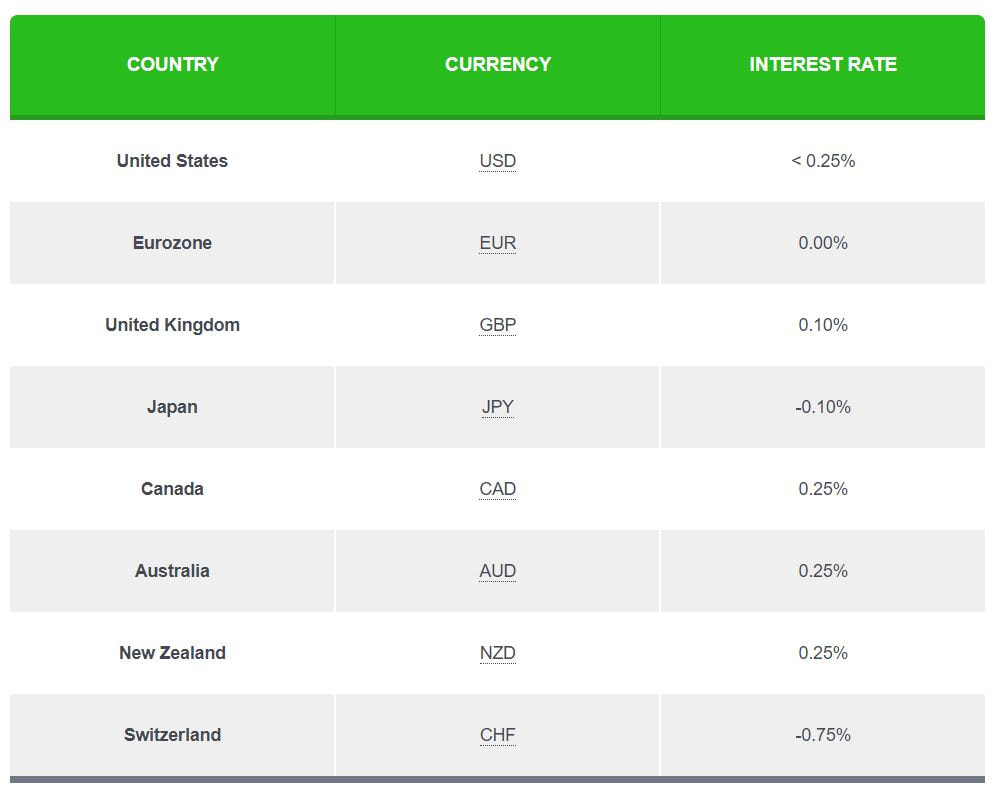

It also means that a relatively small movement can lead to a proportionately much larger movement in the size of any loss or profit which can work against you as well as for you. You could’ve easily LOST $500 in twenty minutes as well. You wouldn’t have woken up from a nightmare. You would’ve woken up into a nightmare! High leverage sounds awesome, but it can be deadly. For example, you open a forex trading account with a small deposit of $1,000. Your broker offers 100:1 leverage so you open a $100,000 EUR/USD position. A move of just 100 pips will bring your account to $0! A 100-pip move is equivalent to €1! You blew your account with a price move of a single euro. Congrats. 👏 RolloverFor positions open at your broker’s “cut-off time” (usually 5:00 pm ET), there is a daily “rollover fee“, also known as a “swap fee” that a trader either pays or earns, depending on the positions you have open. If you do not want to earn or pay interest on your positions, simply make sure they are all closed before 5:00 pm ET, the established end of the market day. Since every currency trade involves borrowing one currency to buy another, interest rollover charges are part of forex trading. Interest is PAID on the currency that is borrowed. Interest is EARNED on the one that is bought. If you are buying a currency with a higher interest rate than the one you are borrowing, then the net interest rate differential will be positive (i.e. USD/JPY) and you will earn interest as a result. Conversely, if the interest rate differential is negative then you will have to pay. Note that many retail forex brokers do adjust their rollover rates based on different factors (e.g., account leverage, interbank lending rates). Please check with your broker for more information on their specific rollover rates and crediting/debiting procedures. Here is a table to help you figure out the interest rate differentials of the major currencies. Benchmark Interest RatesLater on, we’ll teach you all about how you can use interest rate differentials to your advantage.

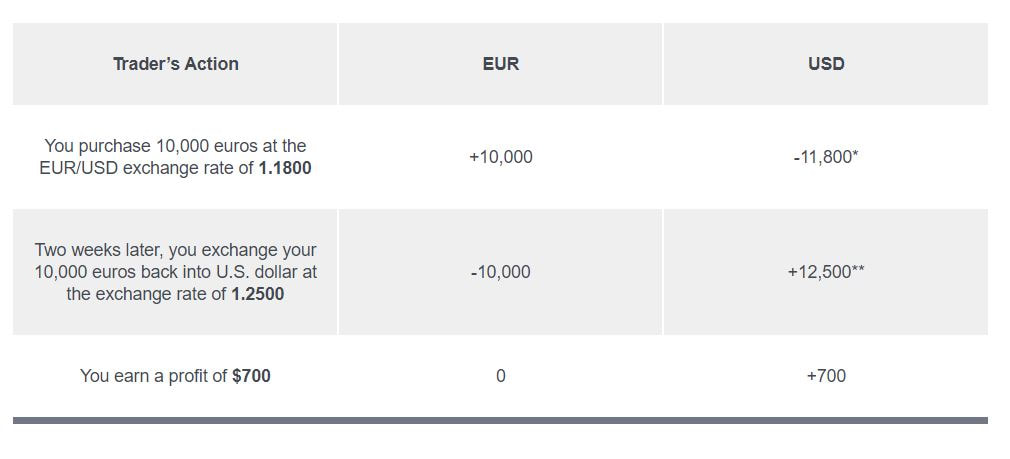

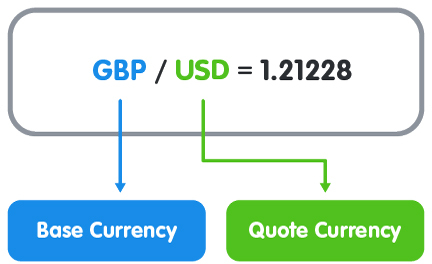

What is forex trading? How does forex trading work? In the forex market, you buy or sell currencies. Placing a trade in the foreign exchange market is simple. The mechanics of a trade are very similar to those found in other financial markets (like the stock market), so if you have any experience in trading, you should be able to pick it up pretty quickly. And if you don’t, you’ll still be able to pick it up….as long as you finish School of Pipsology, our forex trading course! The objective of forex trading is to exchange one currency for another in the expectation that the price will change. More specifically, that the currency you bought will increase in value compared to the one you sold. Here’s an example: *EUR 10,000 x 1.18 = US $11,800 ** EUR 10,000 x 1.25 = US $12,500 An exchange rate is simply the ratio of one currency valued against another currency. For example, the USD/CHF exchange rate indicates how many U.S. dollars can purchase one Swiss franc, or how many Swiss francs you need to buy one U.S. dollar. How to Read a Forex QuoteCurrencies are always quoted in pairs, such as GBP/USD or USD/JPY. The reason they are quoted in pairs is that, in every foreign exchange transaction, you are simultaneously buying one currency and selling another. How do you know which currency you are buying and which you are selling? Excellent question! This is where the concepts of base and quote currencies come in… Base and Quote CurrencyWhenever you have an open position in forex trading, you are exchanging one currency for another. Currencies are quoted in relation to other currencies. Here is an example of a foreign exchange rate for the British pound versus the U.S. dollar: he first listed currency to the left of the slash (“/”) is known as the base currency (in this example, the British pound). The base currency is the reference element for the exchange rate of the currency pair. It always has a value of one. The second listed currency on the right is called the counter or quote currency (in this example, the U.S. dollar). When buying, the exchange rate tells you how much you have to pay in units of the quote currency to buy ONE unit of the base currency. In the example above, you have to pay 1.21228 U.S. dollars to buy 1 British pound. When selling, the exchange rate tells you how many units of the quote currency you get for selling ONE unit of the base currency. In the example above, you will receive 1.21228 U.S. dollars when you sell 1 British pound. The base currency represents how much of the quote currency is needed for you to get one unit of the base currency If you buy EUR/USD this simply means that you are buying the base currency and simultaneously selling the quote currency. In caveman talk, “buy EUR, sell USD.”

Fortunately, the way that currency pairs are quoted in the forex market is standardized. You may have noticed that currencies quoted as a currency pair are usually separated with a slash (“/”) character. Just know that this is a matter of preference and the slash may be omitted or replaced by a period, a dash, or nothing at all. For example, some traders may type “EUR/USD” as “EUR-USD” or just “EURUSD”. They all mean the same thang. “Long” and “Short” First, you should determine whether you want to buy or sell. If you want to buy (which actually means buy the base currency and sell the quote currency), you want the base currency to rise in value and then you would sell it back at a higher price. In trader talk, this is called “going long” or taking a “long position.” Just remember: long = buy. If you want to sell (which actually means sell the base currency and buy the quote currency), you want the base currency to fall in value and then you would buy it back at a lower price. This is called “going short” or taking a “short position”. Just remember: short = sell. “I’m long AND short.” Flat or SquareIf you have no open position, then you are said to be “flat” or “square”. Closing a position is also called “squaring up“. “I’m square.” The Bid, Ask and SpreadAll forex quotes are quoted with two prices: the bid and ask. In general, the bid is lower than the ask price. What is “Bid”?The bid is the price at which your broker is willing to buy the base currency in exchange for the quote currency. This means the bid is the best available price at which you (the trader) can sell to the market. If you want to sell something, the broker will buy it from you at the bid price. What is “Ask”?The ask is the price at which your broker will sell the base currency in exchange for the quote currency. This means the ask price is the best available price at which you can buy from the market. Another word for ask is the offer price. If you want to buy something, the broker will sell (or offer) it to you at the ask price. What is “Spread”?The difference between the bid and the ask price is known as the SPREAD.

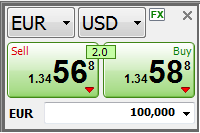

On the EUR/USD quote above, the bid price is 1.34568 and the ask price is 1.34588. Look at how this broker makes it so easy for you to trade away your money.

|

INFIN8ETVWe bring infinite possibilities to our community. ArchivesCategories |

TEAM INFIN8E © 2015

IMPORTANT DISCLAIMER: This website is intended for education purposes only. We are not financial advisor. All content provided herein our website, hyperlinked sites, associated applications, forums, blogs, social media accounts and other platforms (“Site”) is for your general information only, procured from third party sources. We make no warranties of any kind in relation to our content, including but not limited to accuracy and updatedness.

RSS Feed

RSS Feed