|

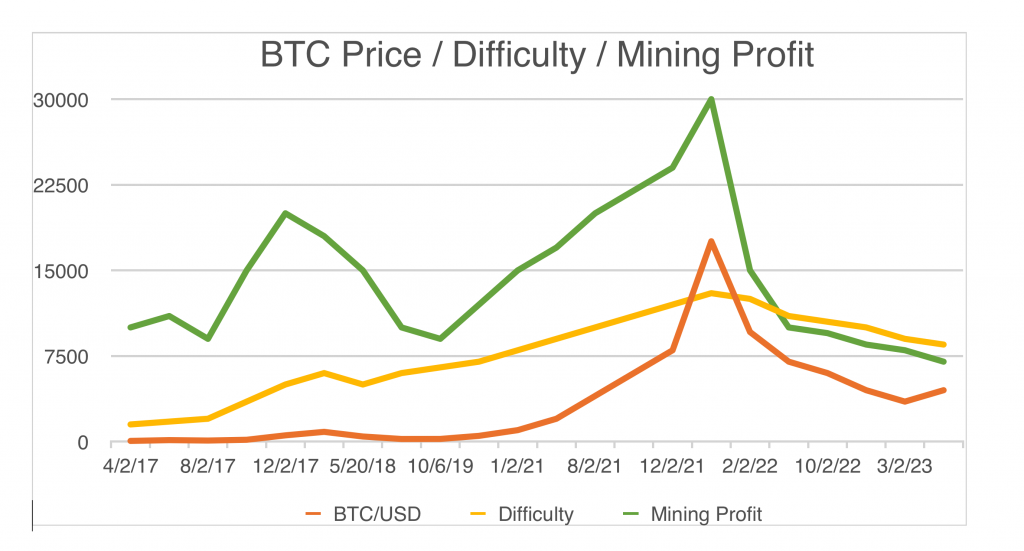

After the storm comes the rainbow.The last few weeks gave us a scene of a collapse in the crypto world: BitcoinCash protocol upgrades lead to a split of the chain. In the Blockchain, these systems’ improvements and protocol upgrades are called “Forks” and they are like any other processes regularly implemented to increase Information Technology (IT) systems. However, in regards this last BCH update, developers had different views about trust protocols and the event ended up on a radical blockchain protocol upgrade, a so-called “Hard Fork”, which meant a split of the chain. They are now: BCHABC and BCHSV. Still, this a relatively common event, since chains split, as it happened with BitcoinCash – a Bitcoin “fork”. But, that’s not all! Unlike other splits that have already happened before, this one came with a sharp fall in cryptocurrency prices. Whenever there is such a protocol upgrade, or “Fork”, the industry’s policy is to inform the market in advance, as it happened in this case. The chain split was properly scheduled with date and time to happen. The doubt, after the upgrade, lays on the fact that some companies have adopted practices not very common in these moments, anticipating the sale of their BCH’s, eventually causing a stronger drop than expected, besides a number of other aspects that may have influenced the sudden fluctuation. Others argue that the fall may also be related to regulatory issues or other uncertainties caused by the upgrade of other systems in the industry, issues that experts often speculate in order to explain above-average oscillations like this one, since they are not so common due to a single system upgrade. But falls often come with highs. How are we going to view this? Right after a sharp fall, due to the current scenario, the market tends to rebound and these dynamics start to restore value for miners up to the point of triggering new highs. At times like this, one of the aspects contributing to recovering cryptocurrency values is the exit of the small and mid-sized mining business, which end up turning their equipment off. For those companies and individuals, the cost to keep equipment active is higher than what they earn out of the operation. However, for larger-sized companies, Mining Difficulty becomes a cause of greater effectiveness because when Mining Difficulty decreases, companies that have greater mining power tend to get better results. In this scenario, the company’s HashRate tends to generate more coins, thus increasing profitability. Taking into account these fluctuations, AWS MINING has prepared a graphical analysis considering the BTC price in the last years and comparing it with the variables of Difficulty and Profitability. By observing the graph below, we can see that Mining Difficulty is influenced by the coin’s value fluctuation and that this variation also affects Profitability. The chart also indicates that a high is followed by a fall and vice-versa. When a fall happens, there is a reduction in the degree of Difficulty and, consequently, a tendency of growth in profitability. When a high happens and there are more people mining at home and small businesses are active, the difficulty increases and mining becomes more competitive. It has been like that since 2013 when Bitcoin was worth USD $ 100.00 and increased 700% in 2014, reaching the price of USD $ 850.00. Then, there was a 70% drop in 2015 and the market rebounded and increased again to 100% in 2016, causing the major historical high in 2017, reaching USD $ 17,000. Now in 2018, the fall was 80%, below USD $ 3,500 and the forecast from now on is that the fall will remain at the current level until the market resettles and a new ‘bull run’, expansion phase occurs.

Against this backdrop, the challenge is to focus on operating with effectiveness and enhancing mining capacity. Besides that, due to the fall of cryptocurrency values and the exit of small and mid-sized mining companies and individuals, it is possible to acquire equipment at more affordable prices. For large-scale mining companies, this is an opportunity to improve effectiveness, since competitiveness decreases and thus our opportunity to mine increases. Likewise, this is a chance to invest more in structure and prepare to mine effectively in any scenario, even when the price rises and consequently Difficulty. Between this and that, when many fear the hurricane and look at it with anxiety, “we perceive that our home is safe”. “We notice that our structures are effective and ready to go through times like this, and that’s why we look at the storm as a growth opportunity, not only because we have the structure we need to grow our mining capacity but also for our ability to further strengthen our structures” says Daniel Beduschi, the company’s COO. “With strong infrastructures, we wait for the after-storm calm and the new challenges that come with it, because the market doesn’t stop and neither does mining” Daniel concluded. Read the Original Article:

0 Comments

Leave a Reply. |

CryptoPreneurClubThe CryptoPreneur Club primary purpose is to teach Filipino’s about CryptoCurrency and become a CryptoPreneur. We will create informative material for them to learn more about Crypto Currency. How it will affect your LIFE in the next coming days!!! Be part of our club and lets teach the world about crypto!!! Archives

August 2019

Categories |

TEAM INFIN8E © 2015

IMPORTANT DISCLAIMER: This website is intended for education purposes only. We are not financial advisor. All content provided herein our website, hyperlinked sites, associated applications, forums, blogs, social media accounts and other platforms (“Site”) is for your general information only, procured from third party sources. We make no warranties of any kind in relation to our content, including but not limited to accuracy and updatedness.

RSS Feed

RSS Feed